Our mission is to deliver a superior risk-adjusted return using proprietary systematic quantitative techniques. By employing this approach, the fund seeks to generate absolute returns irrespective of fluctuations in stock markets, interest rates or currencies.

With a team from different backgrounds such as CERN, Polytechnique, Hedge Funds and top tiers banks and more than 10 years of research we are building long-term performance alongside with a strong risk management.

We have collected millions of data points and developed thousands of variables to create sophisticated algorithms that create returns independently of the market and which excludes human error. We are constantly applying our learnings from artificial intelligence, machine learning, statistical & mathematical modelling, data visualization and pattern recognition to our automatic systems of trading. Quantitative techniques are employed to identify and exploit capital market inefficiencies through strategies both directional and relative value such as trend following, mean reverting, value, growth, low volatility and quality.

The Fund is trading in all cross asset area, in worldwide markets and in different time frequency, bringing diversification. We are investing in liquid markets globally, with a possibility to liquidate our positions between approximately 15 mins to 3 hours.

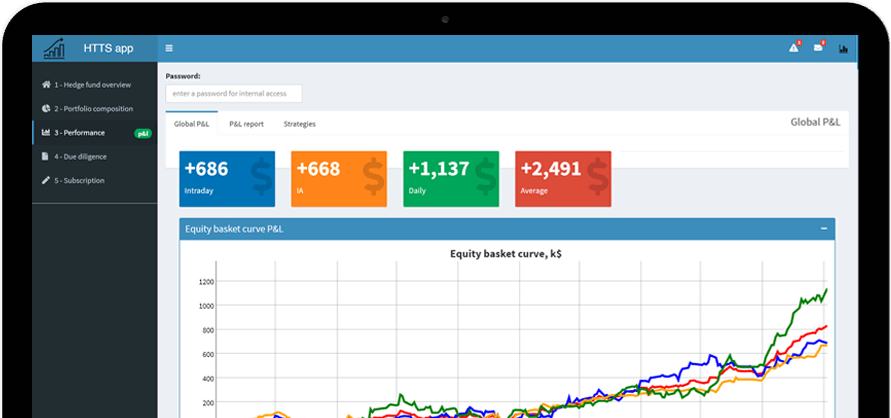

Finally, while the Hedge Fund sector has remained quite opaque, HTTS has in its core value transparency. Indeed, each investor will be able to view daily the number of trades and the PnL through an application we have developed.

Finally, while the Hedge Fund sector has remained quite opaque, HTTS has in its core value transparency. Indeed, each investor will be able to view daily the number of trades and the PnL through an application we have developed.